missouri gas tax increase 2021

The bill includes a refund program for highway vehicles. 1 but Missourians seeking to keep that money in their pockets can apply for a rebate program.

Dividend Yield Stock Capital Investment 19 Jason Fieber Stock Holdings I Would Love To Buy Now Money Centers Graphing Investing

The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct.

. The measure also would increase electric vehicle fees and permit residents to seek refunds of passenger vehicle motor fuel taxes paid in the state. File photo fuel prices at a gas station on US. At the end of 2025 the states tax rate will sit at 295 cents per.

712022 6302023 Motor Fuel Tax Rate increases to 022. Missouri voters havent approved of a gas tax increase since 1996. The legislation includes a rebate process where drivers could get a refund if they save their gas receipts and submit them to the state.

FILE - in this May 22 2014. Parson Signs off on First Missouri Gas Tax Hike in Decades. On October 1 Missourians will see a price increase of 25 cents per gallon.

In this final week of the Missouri Legislatures regular session a proposed gas tax hike is expected to jump into the drivers seat. Senate Bill 262 increases the Missouri motor fuel tax rate over five 5 years by two and one-half cents per year with the first increase beginning on October 1 2021 and increases each year as follows. The law will gradually raise the states 17-cent-a-gallon gas tax to 295 cents over five years with the option for buyers to get a refund if they keep track of their receipts.

The bill would raise Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct. The first 25-cent increase is slated to take effect in October which will bring the states gas tax to 195 cents. Missouri Legislature passes 125 cent gas tax increase.

Mike Parson has signed into law the states first gasoline tax increase in decades. Missouris gas tax will go up by 125 cents over the next five years 25 cents a year starting this October. There is a way for Missourians to get that increased tax money back though.

Missouris gas tax could soon rise for the first time in 25 years after the states. The tax will go up 25 cents a. It is part of the gas tax bill lawmakers passed and Governor Mike Parson approved on July 13.

LIEB May 12 2021. 29 2021 at 503 PM PDT. Governor Parson signed this into law back in May as a way to pay to fix.

MISSOURIS GAS TAX INCREASE TO BEGIN OCTOBER 1. 1 until the tax hits 295 cents per gallon in July 2025. The measure will gradually raise the states 17-cents-per-gallon gas tax by 125 cents over the next five years.

Missouri has one of the lowest gas tax rates in. In 2019 the Missouri Department of Transportation reported 825 million in annual unfunded high-priority improvements. Missouris gas tax will increase for the first time in 25 years but Missourians who dont want to pay the increase have an option.

1012021 6302022 Motor Fuel Tax Rate increases to 0195. Missouri lawmakers pass first gas tax hike in 25 years. 1 until the tax hits 295 cents per gallon in July 2025.

Missouris 17-cent gas tax is one of the lowest in the nation. 169 are displayed between northbound and southbound traffic along Interstate 29 in St. May 10 2021 By Alisa Nelson.

Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes. Drivers could get a refund if they save their gas receipts. The money will be used for Missouris roads and bridges.

Missouris fuel tax rate is 17 cents a. 1 drivers filling up in Missouri will pay an additional 25 cents per gallon of gas. The state will incrementally increase the gas tax by 25 cents annually with the funds earmarked for road and bridge repairs.

Starting Friday Oct. Missouris new state gas tax went into effect in October 2021 at 195 cents and is scheduled to be raised another 25 cents in July of this year to make it 22 cents. By SUMMER BALLENTINE and DAVID A.

The House of Representatives. The tax is set to increase by the same amount yearly between 2021 and 2025. Missouris first motor fuel tax increase in more than 20 years takes effect on Oct.

The first 25-cent increase is slated to take effect in October which will bring the gas tax to 195 cents. Senate Bill 262 increases the Missouri motor fuel tax rate over five 5 years by two and one-half cents per year with the first increase beginning on October 1 2021 and increases each year as follows. Prior to October 1 2021 the motor fuel tax rate was 017 per gallon.

A proposal up for consideration would raise the states gas tax 25 cents per gallon every year for the next four years generating a total of. KY3 - Missouris gas tax increase will go into effect on Friday. 2021 file photo Missouri Gov.

By Cameron Gerber on September 30 2021. 7 hours agoGas tax holiday. 1012021 6302022 Motor Fuel Tax Rate increases to 0195.

Fridays increase will bring Missouris gas tax to 195 cents. Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed.

State Income Tax Rates And Brackets 2022 Tax Foundation

Parson Signs Off On First Missouri Gas Tax Hike In Decades Missouri News Us News

It S Been 10 000 Days Since The Federal Government Raised The Gas Tax Itep

Missouri Fuel Tax Increase Goes Into Effect On October 1

State Corporate Income Tax Rates And Brackets Tax Foundation

Missouri Lawmakers May Ask Voters To Raise Gas Tax In 2021 Transport Topics

New Poll 81 Of New Yorkers Want To Choose Clean Energy Energy Hydro Energy Renewable Energy Companies

Congress Considers Suspending The Federal Gas Tax Fortune

U S States With Highest Gas Tax 2021 Statista

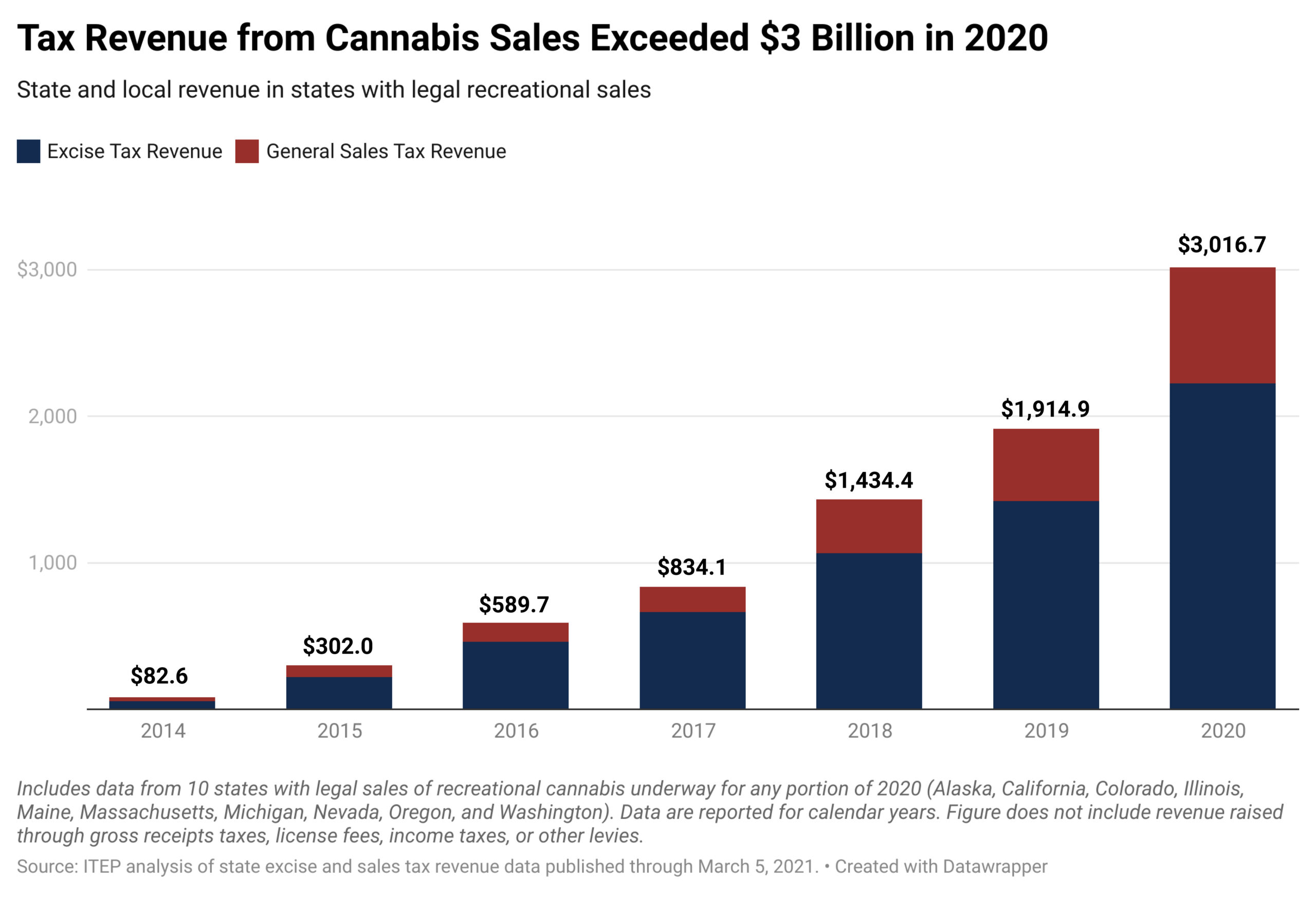

State And Local Cannabis Tax Revenue Jumps 58 Surpassing 3 Billion In 2020 Itep

The Secret To Winning The Loto Revealed Simple Technique Can Win You Millions Youtube Winning Lottery Ticket Lottery Tickets Lottery

Cell Phone Taxes And Fees 2021 Tax Foundation

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Q A How Much Should I Set Aside For Repairs Episode 701 Video Video In 2021 Real Estate Selling Real Estate Real Estate Buying

Increasingly Irrelevant Gas Tax Awaits A Better Idea Roll Call

Gas Tax By State 2020 Current State Diesel Motor Fuel Tax Rates